How to Trade Forex

£27.99

“How to Trade Forex” is an insightful guide designed to help both novice and experienced traders navigate the complexities of forex trading. Authored with a clear and structured approach, this book delves into various aspects of trading, providing readers with practical strategies and in-depth explanations.

Key Highlights

1. Comprehensive Coverage of Candlestick Patterns The book extensively covers candlestick patterns, a crucial element in forex trading. From the basics of what a candlestick is to detailed explanations of specific patterns like the Engulfing Bar, Doji, and Hammer, the author ensures that readers understand the significance of each pattern and how they can be used to predict market movements. The illustrations and examples provided make it easier to grasp these concepts and apply them in real trading scenarios.

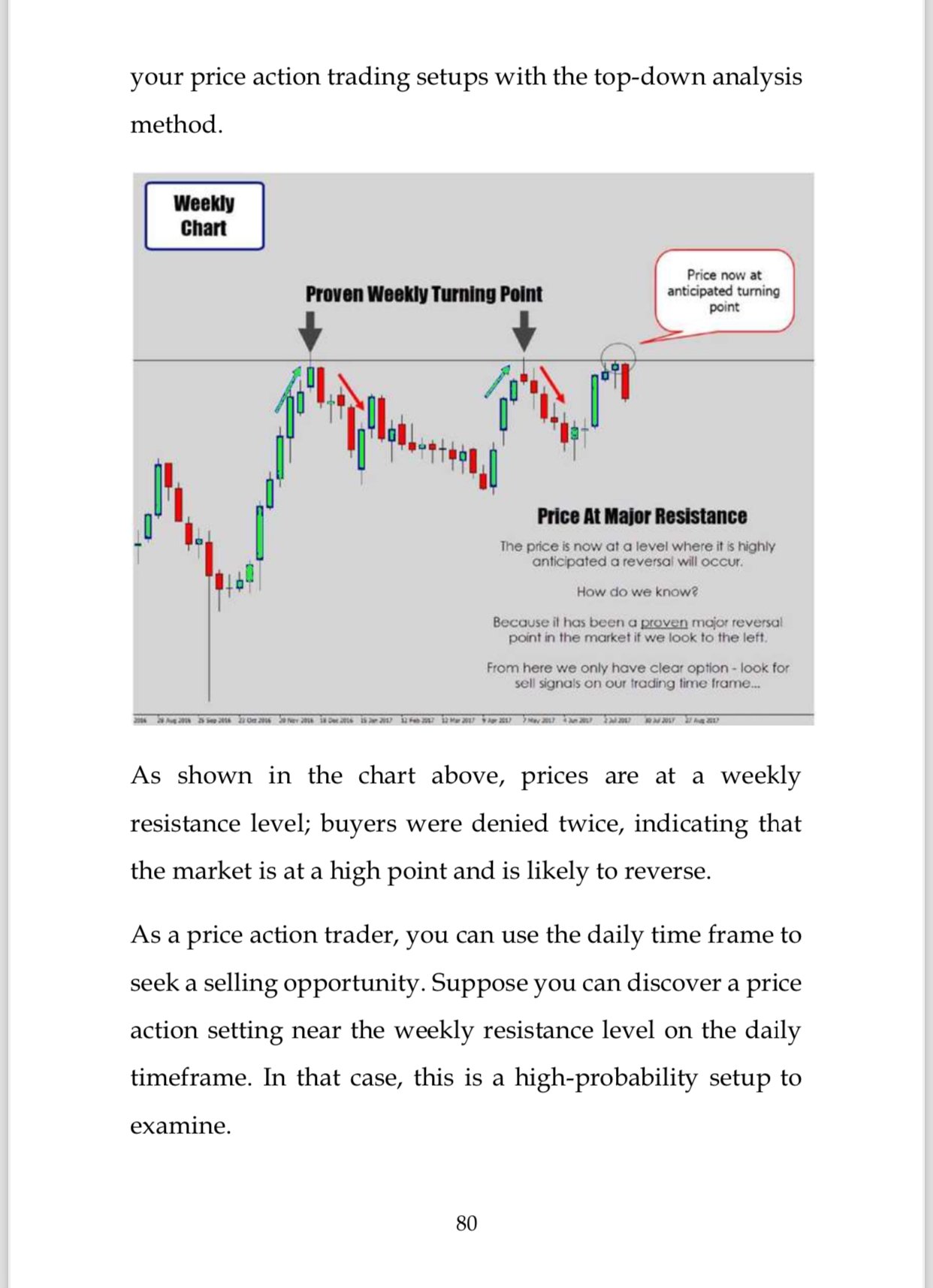

2. Market Structure and Analysis Understanding market structure is vital for successful trading. The book explains how to recognize different market conditions such as trending, ranging, and choppy markets. It also teaches how to draw trend lines and identify support and resistance levels, which are essential for making informed trading decisions. The section on top-down analysis and the use of multiple time frames is particularly useful for developing a holistic view of the market.

3. Trading Strategies and Tactics The book presents various trading strategies, including the Pin Bar, Engulfing Bar, and Inside Bar strategies. Each strategy is explained in detail, with step-by-step instructions on how to implement them. The author emphasizes the importance of understanding the psychology behind these patterns and how they reflect market sentiment. The inclusion of trade examples helps in visualizing the application of these strategies.

4. Money Management A crucial aspect of trading that is often overlooked is money management. The book dedicates a chapter to this topic, providing practical advice on how to manage risk and protect trading capital. The strategies discussed aim to ensure that traders can stay profitable in the long run, even if some trades result in losses.

5. Historical and Theoretical Context The book begins with an introduction to the history of candlestick patterns, tracing their origins back to 18th century Japan and the work of Munehisa Homma. This historical context enriches the reader’s understanding of the evolution of these trading techniques and their enduring relevance in modern trading.

Strengths

- Clarity and Structure: The book is well-organized, with each chapter building on the previous ones. This logical progression makes it easier for readers to follow and understand the concepts.

- Practical Examples: The use of real-world examples and illustrations helps to bridge the gap between theory and practice.

- Focus on Psychology: Emphasizing the psychological aspects of trading patterns adds depth to the reader’s understanding and helps in developing a more intuitive trading approach.

Areas for Improvement

- Author’s Background: While the book is rich in content, a brief introduction about the author’s background and credentials would add credibility and context to the guidance provided.

- Advanced Topics: Although comprehensive for beginners and intermediate traders, advanced traders might find some sections lacking in depth. Including more advanced strategies and techniques could broaden the book’s appeal.

Conclusion

“How to Trade Forex” is a valuable resource for anyone looking to improve their forex trading skills. Its thorough coverage of candlestick patterns, market structure, trading strategies, and money management makes it a well-rounded guide. Whether you’re just starting out or looking to refine your trading techniques, this book provides practical insights and strategies that can help you succeed in the forex market.